by admin | July 16, 2024

Last updated on July 16, 2024,

HDFC Bank, India’s leading private sector bank, provides Online NetBanking Services & Personal Banking Services like Accounts & Deposits, Cards, Loans, Investment & Insurance to its customers. HDFC Securities, a subsidiary of HDFC Bank, has launched an innovative discount broker called HDFC Sky.

Every trader and investor can enjoy a great experience with various trading and investment solutions. They offer free account opening and a flat brokerage fee of up to Rs. 20. Plus, there’s the new HDFC SKY trading app! If you’re interested in opening an account with HDFC Sky, be sure to read this detailed HDFC Sky review to the end.

HDFC Securities has introduced the HDFC SKY platform (website and app) to the low-cost brokerage market. On a single platform, the account will offer access to Indian stocks, mutual funds, futures and options, commodities, currencies, initial public offerings (IPOs), and international shares.

Table of Contents

HDFC Sky: Company Overview

| Company Type | Private |

| Headquarters | Mumbai |

| Founder | Dhiraj Relli |

| Establishment Year | 2023 |

| Broker Type | Discount Broker |

| Active Clients | 50,000+ |

| Account Opening Charges | Free |

| Check HDFC Sky Offers | Click Here |

About HDFC Sky

HDFC Securities created HDFC SKY, a discount broking system, to meet the growing demand for discount broking apps in India. HDFC Sky is a place where you can do all your trading and investing stuff easily. It covers Indian stocks, mutual funds, equity derivatives, and fixed-income securities. Plus, HDFC Sky is approved to trade on BSE, NSE, MCX, and MSEI.

Any person can open a HDFC Sky demat account for free, without any starting fees. Moreover, for every intraday and delivery trade, it charges a low flat brokerage fee of Rs 20 per completed order. Regardless of how many trades you make, you only pay Rs 20 each time.

The HDFC Sky app, designed for discount broking, is a complete tool for trading and investing in various types of assets and markets. It comes with lots of useful features like portfolio management, a smart dashboard, quick transaction processing, and many others!

In addition to the features for trading and investing, it gives you free access to 23 years of insightful analysis from HDFC Securities. Prominent discount brokers, such as Groww and Zerodha, do not provide advisory or analysis services.

Top Features of HDFC Sky

The app promises features like Quick Trades, Portfolio baskets, Intuitive Dashboards, trading with minimal downtime, and customer and data security.

People Also Read:- Stock trading for beginners

The HDFC Sky app’s KART function enables traders to submit several orders at once. Instead of making a single deal, traders may use this to purchase or sell a number of stocks at once with a single tap.

- HDFC SKY provides a good Market Overview and market Depth Information; the platform features good mobile and online apps.

- Charting tools like Tradingview and ChartIQ are included with the broker.

- HDFC SKY offers a broad choice of financial services for trading and investing

- Users may also invest in US stocks using the platform

- The apps feature a fast UI for quick transactions

- The platform includes robust paperwork and FAQs for easy reference

HDFC Sky: Investment Options

Users of the app can invest in Indian equities, US bonds, mutual funds, exchange-traded funds (ETFs), or fixed-income instruments, according to evidence on HDFC Sky’s official website. Users of this software can trade in shares of more than 100 ETFs and 3,500 listed businesses.

Additionally, the app lets users invest in more than 2000 mutual funds in a variety of industries. The app gives investors in mutual funds fast access to NFOs and automated SIPs. The app offers comprehensive analysis (paid expert views), portfolio tracking, and the ability to plan out an investor’s savings strategy.

The HDFC Sky app makes it easier for consumers who are interested in foreign stock to participate in over 500 foreign firms by allowing fractional investment, which makes purchasing and selling in small amounts easier.

HDFC Sky app: Fees

The HDFC Sky app does not currently impose an account opening fee for trading or demat accounts. For the first year, there are no maintenance fees associated with the app, and deliveries of equity, F&O, currency, and commodities are available for Rs 20 per transaction on an intraday basis. Before using this app, consumers should evaluate its features and cost against those of other well-known applications and platforms.

- Trading Account Opening Charges: Free

- Trading Account AMC: Free

- Demat Account Opening Charges: Free

- Demat Account AMC: Rs 240

Now is the time to review the brokerage fees. Moreover, the brokerage fees for HDFC SKY are:

| Equity Delivery and Intraday | ₹20 or 0.1% (Whichever is Lower) |

| US Stocks | 5 cents per Share |

| Currency Futures Intraday and Carry Forward | ₹20 or 0.1% |

| Commodity Futures Intraday and Carry Forward | ₹20 or 0.1% |

| ETF Intraday and delivery | ₹20 or 0.1% |

People Also Read:- Lowest Brokerage Charges In India

It’s important to remember that most budget brokers do not charge a brokerage fee for equity delivery or exchange-traded funds (ETFs), but HDFC SKY does. In addition, the fees associated with Equity Intraday and Futures are rather more than those of reputable bargain brokers such as Zerodha.

Different types of Account by HDFC Sky

Any resident of India is eligible to register a digital trading and demat account with HDFC Sky. But as it doesn’t support NRI trading, NRIs are unable to trade with HDFC Sky. A brief overview of the HDFC Sky 2-in-1 account is provided below;

HDFC Sky Trading Account

To enable clients to place and carry out buy and sell orders in the chosen section, a trading account is created. 100+ ETFs and 3,500+ equities are available for customers. The HDFC Sky platform allows users to invest globally in US-based equities and exchange-traded funds (ETFs).

Transferring money to your trading account, adding the scrip to the watchlist, and placing a buy/sell order are all you have to do to begin trading with HDFC Sky.

You can use net banking or your UPI to fund your trading account. Transferring money over the UPI gateway is free of charge. To trade and invest, you do not need to keep a minimum amount on your HDFC Sky account.

People Also Read:- Best Trading App in India

HDFC Sky Demat Account

Customers may create a demat account with HDFC Sky, a DP that has both CDSL and NSDL, in order to facilitate the process. Every investment you have made, including stocks, mutual funds, initial public offerings, and shares, is securely kept or credited to your HDFC Sky Demat account.

All of your belongings or investments are visible in your Demat account. Your money is digitally safe and secure with a demat account.

People Also Read:- Best Demat account in India

HDFC Sky Mutual Fund Account

You will have immediate access to mutual fund investing if you have created a trading and Demat account with HDFC Sky.

The broker facilitates hassle-free investment in more than 2000 plans from the top 29 asset management organizations without charging brokerage or commissions. You have two options for investing: you may use SIP automation or make a single, large payment.

You can access external mutual funds, receive professional advice and proposals for the finest mutual funds, and then evaluate up to five mutual fund schemes with the HDFC Sky app.

HDFC Sky Review: Pros and Cons

| HDFC SKY Pros: | HDFC SKY Cons: |

| There are no account setup fees. | Limited client service |

| Lower brokerage fees | |

| Free AMC for the first year | No desktop trading platform |

| Highly intuitive apps for mobile and online platforms | |

| Charting tools like ChartIQ and Tradingview | No direct mutual fund offerings |

| Vast selection of financial goods | |

| Various order kinds | |

| Advance orders such as basket, cover, or GTT orders | Delivery trading is not free of charge, but Zerodha provides free delivery trading; |

| Learning platform for beginners to professionals | |

| No minimum balance obligations |

HDFC Sky Trading platform

| HDFC Sky Android App Download | Android App |

| HDFC Sky iOS App Download | iOS App |

| HDFC Sky Web Trading Platform Download | Web Trading |

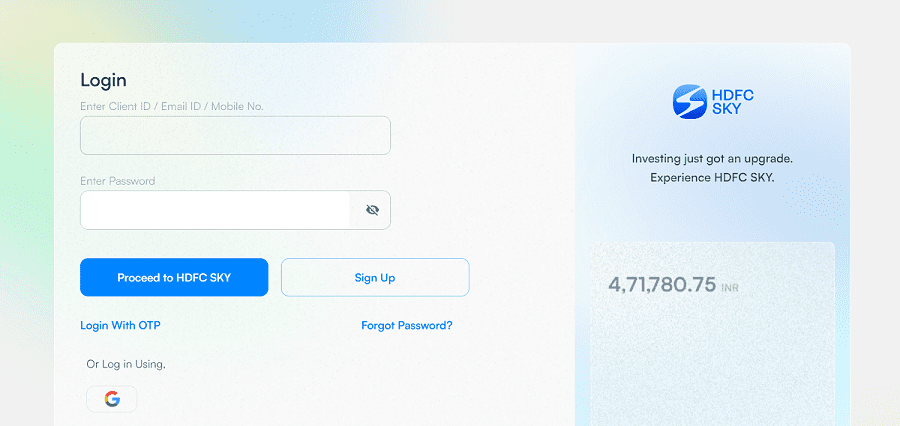

How do you login to the HDFC Sky app?

Tap Login Here after opening the HDFC Sky app. In case you haven’t made an account yet, click Sign Up and finish the KYC procedure. You may access your trading account by tapping Login.

There will be a pop-up window. Put in your login information. To access your HDFC Sky account, you can use your client ID, email address, or cellphone number. A one-time password (OTP) will be issued to your mobile phone when you continue.

How can I go from SKY to HDFC?

You must first close your existing HDFC Securities account in order to start the transition. It’s vital to remember that if you have no demat balances, low balances, open positions, or outstanding orders linked with the customer’s account, utilizing the e-closure link can result in the closing of both the trading and demat accounts, especially if you have a demat account with HDFC Securities.

Once you create your SKY account, you must handle the closing of your demat account and transfer of investments in the SKY demat by sending a Demat closure cum transfer form.

Additionally, you have the easy choice to use the “CDSL Easiest” technique to transfer just your assets from your current HDFC Securities demat account to the HDFC SKY account.

People Also Read:- A Step-by-Step Guide to Learn Trading

HDFC Sky Customer Support

| Trading Support:- Available, Free | Dedicated Dealer:- Available, Free |

| Call Support:- 1800 121 2109 | Email Support:- [email protected] |

| Compliance Officer:- Call:- 022-3045 3600 Email:- [email protected] | Website:- HDFC Sky Website |

Conclusion

Users can utilize this app to invest in global assets, IPOs, stocks, derivatives, currencies, commodities, mutual funds, and ETFs, all from a single platform. Each order, except for global investments, incurs a fee of Rs 20. In short, HDFC Sky is a strong discount brokerage firm with a flat pricing model of Rs 20, putting it in line with companies like Groww, Upstox, Zerodha, and others. Additionally, HDFC Sky offers extra services such as top-rated mutual fund schemes.

We trust that this HDFC Sky Review has provided all the essential details to understand the brokerage firm and make investment decisions accordingly.

FAQs on HDFC Sky

Check out different FAQs regarding HDFC Sky Review here.

Q.1 If I currently have an HDFC Securities account, why am I unable to register an HDFC SKY account?

Ans:- A client is not permitted to have multiple trading accounts under the same brokerage business under SEBI regulations. Since HDFC SKY is a division of HDFC Securities, customers must select and maintain an account with one platform.

Q.2 Does canceling my account come with any fees?

Ans:-No, there aren’t any fees associated with closing an account.

Q.3 How long does it take to close my trading account?

Ans:- After the e-closure request is submitted, your trading account will be terminated in T+2 days (where T is the number of trading days).

Q.4 How can I transfer my investment in HDFC Securities to HDFC SKY?

Ans:- Using the “CDSL Easiest” approach, you may easily move your assets from your HDFC Securities account to the HDFC SKY demat account.

Q.5 How is HDFC SKY different from HDFC Securities in terms of fees?

Ans:- Although HDFC Securities costs ₹999, HDFC SKY provides a free account opening and operates on a discount broking basis. For the first year, there is no AMC; after that, an AMC of ₹240 is charged.

Q.6 What paperwork or data is required for the digital closing of my account?

Ans:- You only require your Aadhaar card number to complete the e-closure process; after submitting it on E-Sign, you will get an OTP on the mobile number and email id linked with your Aadhaar card. No other papers are required.

Q.7 Is HDFC SKY a better option for investors and traders than other top discount brokers?

Ans:- Because HDFC SKY is new and has somewhat higher fees, traders and investors who currently use top online discount brokers might not find it appealing. The price on the platform might need to be changed to better suit the discount broking market.

Q.8 What distinguishes HDFC SKY from other low-cost brokers?

Ans:- The main benefits of HDFC SKY involve free account opening, no annual maintenance charge (AMC) for the first year, and access to a variety of financial instruments, like US stocks. It also provides depth data and a great market perspective.

Q.9 Is HDFC Sky secure?

Ans:- Yes, the HDFC Sky app is a secure and reliable mobile trading software since it uses 256 AES encryption to safeguard all sensitive client data. To avoid any unwanted access, the software also offers customers fingerprint authentication-based biometric login functionality.

Q.10 Is the HDFC Sky app suitable for new users?

Ans:- Indeed, the HDFC Sky app provides customers with an elegant UI/UX design that makes the platform user-friendly for all users, in addition to being a modern mobile trading tool. With the HDFC Sky app, you may trade or buy in stocks, equities, F&O, currencies, and commodities, regardless of your level of experience.

I’m not sure where you’re getting your info, but grteat topic.

I needs to spend slme time learning much more or understanding more.

Thankks for wonderful information I was looking for this information for my mission.