Last updated on August 1, 2024

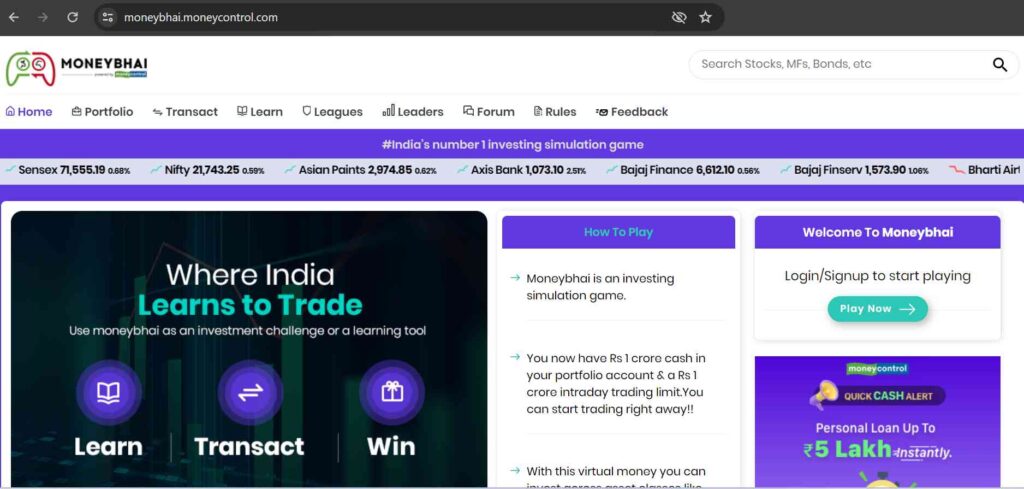

MoneyBhai is one of India’s largest virtual trading game simulator by Moneycontrol.com. It is loaded with tons of wonderful features that help its users learn stock trading in an effective and risk-free way. Moneybhai is an investing simulation game in which users get Rs. 1 crore cash in their portfolio account with a Rs. 1 crore intraday trading limit.

Moneybhai lets people trade pretend money in different things like mutual funds, stocks, and fixed deposits. It’s free to use, and you don’t have to open a special account to try it.

This moneybhai review brings you complete insight into key features, guidelines, and STT and brokerage charges.

Table of Contents

More about Moneybhai

In simple terms, Moneybhai is like a pretend trading game. You use fake money on the Moneybhai app or website to make investments. You can set up an account, get a limit for buying and selling on the same day, and invest in different things like fixed deposits, stocks, bonds, and mutual funds.

The platform works like a real trading account but doesn’t involve actual money. It uses real market data and shows users live positions. Users can also reset their portfolio balance, which regular brokerage accounts can’t do. Plus, the site provides educational materials to help users understand technical terms such as GTC orders, STT, square off, open positions, stop loss, brokerage, limit orders, target price, and more.

Moneybhai app assists 18–34-year-old novices in the market and does research for back testing strategies. To simulate an actual online brokerage account, it will make use of actual stock market data and news.

The investors would be able to purchase shares, mutual funds, commodities, fixed deposits, and other items with a capital of one crore. If investors believe that their investment choice was incorrect, they are free to reset their portfolio lower down to the original rate of Rs 1 crore.

Key Features of Moneybhai mobile app

Next-level trading experience: To improve the simulated trading experience, Moneybhai virtual trading game simulator app makes use of stock-related data from actual stock market scenarios.

Section on investments: Moneybhai makes it simple to monitor your portfolio, transaction history, profit and loss figures, and a lot more.

League formation: Investors can engage in competition with one another by organizing leagues. Even their relatives and friends are welcome to attend.

Learning component: To gain suitable investment techniques, Moneybhai app features a dedicated learning area.

Guidelines for Moneybhai Moneycontrol App

While using the Moneybhai mobile app or portal, the users need to take into account a number of things as defined below:

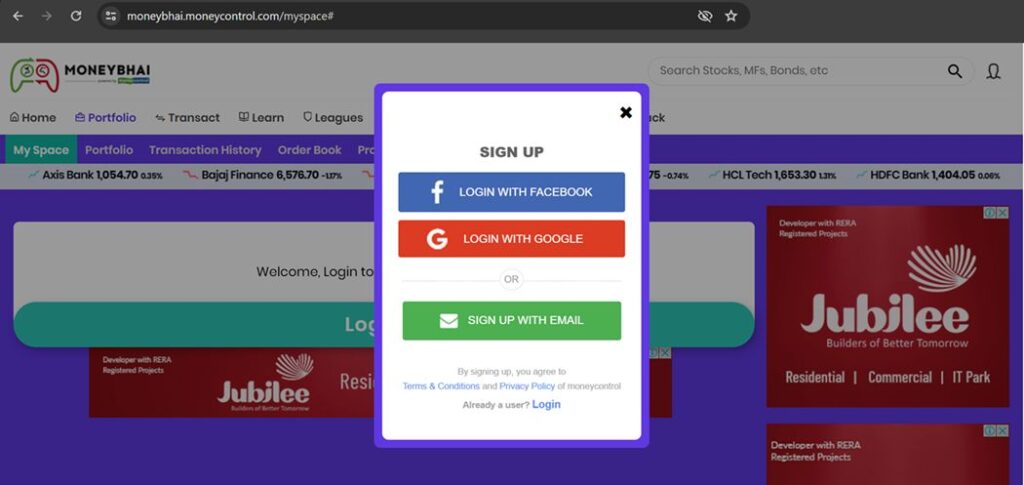

- Investors are supposed to register themselves on the Moneybhai.moneycontrol.com virtual trading website or mobile app through an email Id, Google, or Facebook

- Every user is required to do Moneybhai moneycontrol login at least once a day to make a claim to invest game prize.

- Upon opening an account with Moneybhai, investors will receive a virtual cash deposit of one crore into their portfolio account. His account will be immediately set to the intraday limit.

- An investor can use virtual money to purchase any permitted asset, including bonds, stocks, mutual funds, and fixed deposits.

- Every intraday transaction must be settled by the investors. For example, the actual intraday trading position must be closed by 3.30 pm in order to avoid being automatically squared off.

- The trading limitations will be determined daily based on the virtual Net-worth of Moneybhai.

- All split and bonus rules and regulations will be applied in accordance with actual; purchase and sell transactions cannot exceed actual market volumes.

- The sort of deal that is conducted will determine the brokerage fee payable on the Moneybhai virtual trading simulator platform.

- Moneybhai has all the rights, at their sole discretion, to remove, alter, or even reset a user’s portfolio.

- Everyone receives ₹1 crore in virtual currency, which they can use to invest in mutual funds, equities, commodities, or fixed deposits.

- Real market data from the share market is used by MoneyBhai. This provides exposure in real time, much like trading in a brokerage account.

- Every twenty minutes, your leaders dashboard is refreshed. When you observe others who are succeeding, you decide to emulate them in order to improve your own approach.

How to practice trading through Moneybhai App?

Practicing stock trading on Moneybhai trading simulator app is very easy as you just need to follow a few steps to get your hands on this fabulous virtual trading web portal.

Register yourself on the app and proceed to Moneybhai login:- The first thing to do is to register yourself on the Moneybhai app using your mobile no., email id, Facebook, or Google account. After registering, use the credentials to do Moneybhai login.

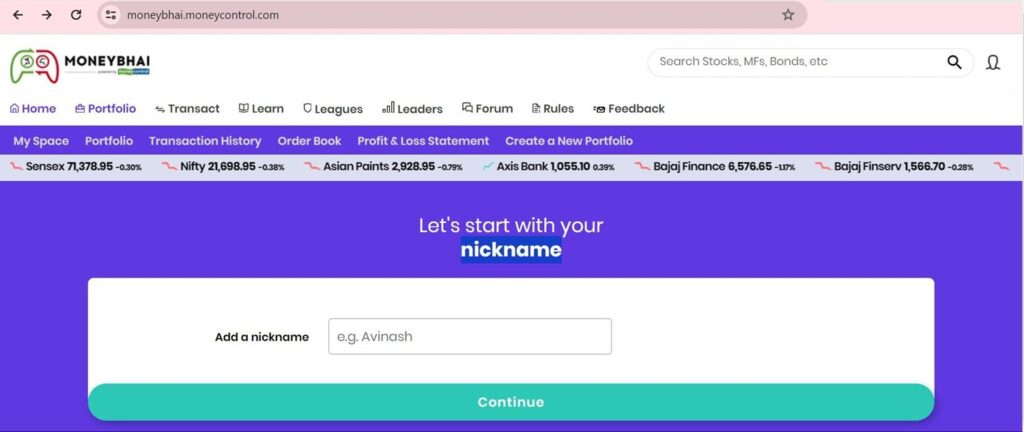

Choose a nickname:- The next thing you should do is to choose a nickname as per your own wish. The name should be unique and it shouldn’t be taken by any other user.

Name your portfolio:- Now, it’s time to give a name to your portfolio. Once this is done, you can choose to play the virtual trading game simulator on Moneybhai moneycontrol app.

Check the dashboard:- After you complete all the formalities, you will be landed on your dashboard. Here you will come across various fields to place a buy or sell order.

Search for the stocks:- Now you need to search for the stocks you are willing to trade. Just type the name in the search box and click search.

Place an order:- Once you get the stock you are interested in, you need to place an order by entering variables like the quantity, price type, order validity, target price, stop loss, and reason to buy this stock. Then, click on “Done”

Check “My Investments” section:- Once you carry out transactions, your portfolio will be updated. You can check your portfolio anytime by clicking the “My investments” link given at the bottom of the page.

Moneybhai App Rating and Download Link

The Main Menu – Moneybhai Moneycontrol Virtual Trading

On the top of the page of Moneybhai virtual trading game simulator portal, you can check the main menu that contains various important links like:

My Space

- In this section, you can get an overview of your Moneybhai account. For example, you can check the existing worth of your portfolio along with ranking, today’s gain/loss, and overall gain and loss.

- Your balance limit of Rs. 1 crore will be shown here.

- You can also get to know the top gainers and top losers in this section.

- Under the Activities tab, you can take a look at all the major activities done against your profile.

- Under the “Messages” section, you can join the community and ask your queries. You can also see the replies made to your query.

Portfolio

As its name indicates, this section of Moneybhai virtual trading simulator app highlights every single element related to your portfolio. For example, you can check your investments, total profit/loss, and other things across different asset categories like mutual funds, stocks, bonds, and fixed deposits.

Transaction History

In this section, you can check all your buy and sell orders you placed so far.

Order Book

You check all the orders (buy/sell) placed against your portfolio. Please note that there are two types of order you can place on Moneybhai mobile app – Limit Order, Market Order, and GTC

Profit & Loss Statement

As evident, get your overall profit & loss statement. You can also narrow down the results by using the given filters.

You can create multiple portfolios against one account.

Applicable charges

STT and brokerage charges

- Moneybhai charges brokerage the same way it does for regular trading accounts in order to maintain things as realistic as possible.

- Moneybhai will charge 0.50% for stocks, 0.10% for intraday stocks, 0.50% for mutual funds when you sell the fund, and 0.50% for bonds in Moneybhai. Currently, ₹ 20/-per order is charged by several reputable brokerages (Zodha, Upstox) for intraday trades, and ₹ 0 for delivery transactions.

- STT is likewise applied to equity at the government rate of 0.125 percent.

Also Read:- Guide to Learn Trading

Conclusion

For those looking forward to a smoother and effective stock trading experience, Moneybhai moneycontrol virtual trading game app is the best choice. Loaded with all the real-market features, this virtual trading platform is great for both novice and experienced traders who can gets their hands on different trading strategies.

FAQs on MoneyBhai

Q.1. Do I need to pay anything to use Moneybhai by Moneycontrol?

Ans:- No. Moneybhai moneycontrol app is completely free and anyone can take part in this virtual trading game simulator.

Q.2. What is Moneybhai?

Ans:- Moneybhai is one of the most popular virtual trading game simulator platforms in India. The platform is backed by Moneycontrol.

Q.3. How much amount of virtual money does Moneybhai provide?

Ans:- Moneybhai Moneycontrol virtual trading simulator platform gives the virtual currency of Rs. 1 crore to invest across different asset categories.

Q.4. Is Moneybhai free?

Ans:- Yes, MoneyBhai virtual trading game simulator platform is free where you get Rs 1 Crore in Virtual Cash upon registration. You can use this amount to invest in shares, commodities, mutual funds or fixed deposits available on the platform.

Q.5. What are the primary features of Moneybhai?

Ans:- MoneyBhai offers a virtual trading platform that replicates the dynamics of the stock market, allowing users to understand its intricacies using virtual currency. It serves as a valuable tool for learning online transaction methods and mastering stock market strategies without the risk of real financial loss. If users make a mistake, they have the ability to reset and start fresh.