The Indian capital market is divided into two key segments, which are responsible for its functioning, growth, and contribution to the economy: Difference between primary market & secondary market. Although both the markets deal in the exchange of securities, they differ from each other with respect to functioning, purpose, and objectives. This blog highlights the difference between the primary market and the secondary market and provides a detailed overview of their key features.

What is the Primary Market?

The primary market is that segment of the stock market where the securities are issued to the general public for the first time. The securities used in the market for public offerings include bonds, shares and debentures. In this market, the companies and investors directly interact with each other for the exchange of securities and funds.

Raising capital through the primary market is one of the easiest ways for companies, as the proceeds go directly to the company’s account and the process is hassle-free. The funds raised by the company in the primary market are used to meet various short- and long-term expenses, including handling day-to-day operations, business expansion, launching new products, and debt repayment.

Key Features of the Primary Market

The primary market has distinct and unique features that make it different from the secondary market. Here are some of them:

1. Issuance of New Securities

The primary market is the only way through which companies can issue fresh or new shares in the market. This market offers a platform to companies to attract direct investment from investors through initial public offerings.

2. Direct Interaction

The companies directly interact with the investors in this market, eliminating middleman or agent services. This direct connection allows businesses to raise huge capital and operate properly.

3. Price Determination

In a primary market, the price of the security is determined after considering the company’s worth, financial requirements, and market conditions, ensuring that it reflects the true value of the securities. Once the price of securities is fixed by the companies, it cannot be changed. The investors only have the choice to determine how much they want to invest.

4. Capital Formation

The primary market plays a key role in capital formation by directing savings from investors and financial institutions to companies, providing a means of a smooth flow of income. This process further boosts the growth of the country.

What is the Secondary Market?

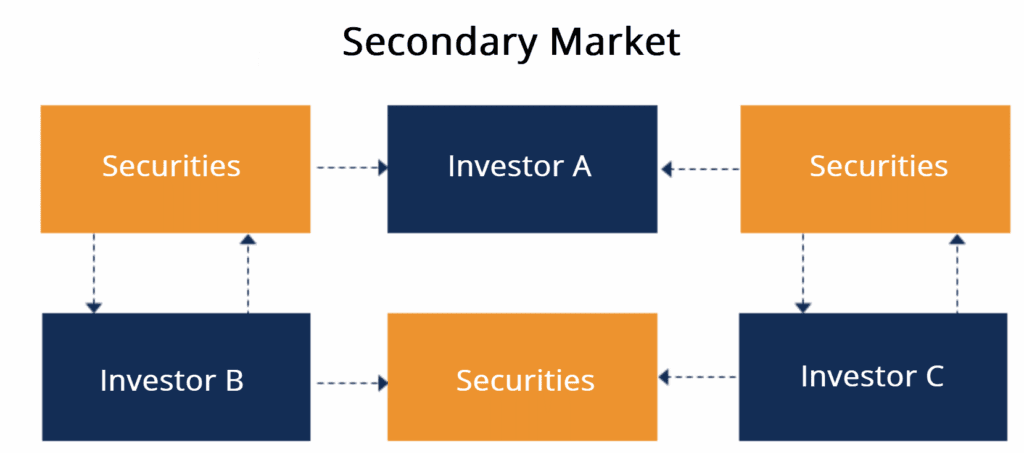

The securities which are already introduced and issued in the primary market are traded in the secondary market. This trading activity takes place between different investors. There is no involvement of companies. The different types of securities available for trading in the secondary market include bonds, derivatives, and shares.

This market is highly liquidated and allows investors to effortlessly buy and sell their shares. The price of securities usually fluctuates in this market and is not fixed by any authority or investor.

Key Features of the Secondary Market

The secondary market is the best platform for investors to exchange their securities or invest in different securities. It has the following features:

1. Liquidity

It is one of the critical and essential aspects of this market. Liquidity, in the market context, refers to the degree to which a security can be easily converted into cash without affecting its value.

2. Price Fluctuation

In a secondary market, the price of securities, whether shares, bonds, or derivatives, fluctuates in proportion to the fluctuation taking place in the market. The price of the securities increases with the increase in demand and falls with the fall in demand.

3. Transparency

Transparency in the market refers to a unique system that ensures all trading activities take place in an open market. It allows investors, participants, and other authorities to access market data and prices in real-time.

4. Accessibility

The secondary market is accessible, and any participant or investor can easily trade in this market without any difficulties. There are many online trading platforms that allow investors to access market information easily, anytime from the comfort of their home.

Primary and Secondary Market Examples

A primary market is a platform to trade different types of securities. Some examples of key securities traded in this market include IPOs (Initial Public Offerings), FPOs (Follow-on Public Offer), equity and preference shares, government or corporate bonds, notes, bills, and debentures.

A secondary market, sometimes called an aftermarket, is a platform where the securities once issued in the primary market by companies or the government are actively traded again and again between investors. The key examples of the secondary market include the NSE (National Stock Exchange) and the BSE (Bombay Stock Exchange)

Key Difference Between Primary Market and Secondary Market

Here’s a quick overview of the comparison between the two markets:

| Basis | Primary Market | Secondary Market |

|---|---|---|

| Purpose | Enabling companies to raise capital | To provide more liquidity in the market |

| Parties Involved | Investors and the company | The exchange of securities takes place between different investors |

| Types of Securities Exchanged | Shares, bonds, or debentures issued for the first time | Securities already issued in the primary market |

| Price of Securities | The price of securities, whether shares, debentures, or bonds, is fixed by the companies | The price of securities is not fixed or regulated in this market and keeps fluctuating |

| Sale of Security | Securities are for sale and purchase for one time only | Securities are for sale and purchase for an indefinite period of time, or as long as they are listed on the stock exchange |

| Liquidity | There is low liquidity in the market | There is high liquidity in the market |

| Regulatory Bodies | SEBI (Securities and Exchange Board of India) | Stock Exchange (NSE and BSE) and SEBI |

The Closing Statement

The primary market and the secondary market are two unique and distinct platforms that channel the savings from investors to companies. It contributes to the overall economic growth and capital formation. Understanding the difference between these two markets is essential for investors to make a smart investment decision. While in the primary market, only new or fresh securities are introduced for one time, in a secondary market, the investor can buy or sell any existing securities multiple times.

Frequently Asked Questions

Why should investors prefer trading in the secondary market rather than the primary market?

Investors should invest in the secondary market offers high liquidity, accessibility, and multiple investing opportunities.

Are investors allowed to fix a certain price of a security in the secondary market?

No, an investor cannot fix a certain price of the security in the secondary market. The price keeps fluctuating due to different uncertain circumstances.

Can security be initially introduced in the secondary market?

No, a security can initially be introduced or offered for sale in the primary market only.