In trading, different patterns, data and charts are generally used to identify the market changes and fluctuations. This analysis helps the trader to understand when to enter and exit the market. Every trader uses a different pattern according to their preferences and suitability. One of the most comprehensive, easy-to-understand, and highly recommended patterns used by traders is the Shooting Star Candle Pattern. Let’s see in detail what it is.

What is the Shooting Star Candlestick Pattern?

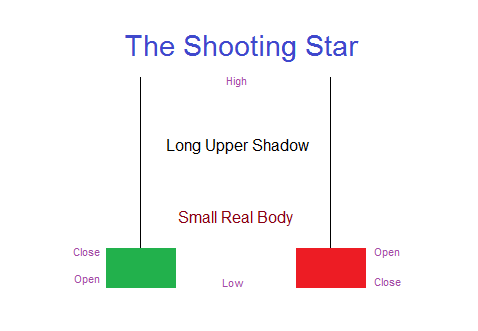

A shooting star candlestick pattern reflects a sharp increase in the asset’s price that, after the end of an uptrend, quickly goes downward to its opening level. The upward and downward movement of the market creates a pattern that looks like a candlestick having a long upper wick and small or no lower wick, along with a small body.

A candlestick is considered as a shooting star only when the upper wick should go upward till it reaches half of its total length. This pattern reveals a high price of the asset, a bearish reversal signal, and a warning that the upward momentum is soon going to break, leading to a sharp decline in price.

Traders dealing with this type of stock market activity must carefully analyse the candlestick pattern, have a good knowledge of the market, and deep understanding of how it works.

Different Types of Shooting Star Candlestick Patterns

There are different types of shooting star candlestick patterns, including the following:

1. Classic Shooting Star

Classic shooting start is usually formed or observed after the end of an uptrend. It reflects that initially the prices are significantly increased by the buyer, but the seller rationally does not make a decision to invest in them, causing the price to go down again. Near the lower and upper wick, you can spot this star highlighted by a red body.

2. Bearish Shooting Star

A bearish star reflects a high bearish reversal and the probability that the asset’s prices are soon going to decline sharply. On the pattern, among various upper or lower stick, you can spot this star between a small body near the lower end and a long upper shadow. Traders need to carefully examine it to understand the upcoming situation in better way.

3. Inverted Shooting Star

Reflected by a hammer-like structure, this star appears on the learn trading pattern after a downtrend. It suggests that while the prices of the asset decline, it may go upwards due to a significant change in the buyer’s position.

How to Interpret the Shooting Star Candle Pattern?

A shooting star candle pattern or a reversal pattern reflects a reversal in a significantly upward trend in the market. The appearance of this star indicates that the buyer is pushing the price frequently, leading to the indicators moving upward. However, once the session reaches its peak, the price starts to fall almost to the opening price. This situation has only one explanation: the buyer lost control of the uptrend, causing a reversal.

When the next candle starts to form, it again reflects a reversal in the market, indicating that the buyer has restored its position and pushing the price again. These conditions reflect the ideal situations and time for trading. However, the traders should be cautious as the market can shift anytime due to unavoidable situations.

How to Trade Using the Shooting Star Candle Pattern

To efficiently trade with a shooting star candle pattern, traders can use the following tips:

1. Identify the Pattern

First and foremost, you need to identify the spot where the shooting star candle pattern is forming. To ideally identify it without any mistake, look for a long upper wick and a small real body.

2. Confirm the Pattern

Relying solely on the candlestick pattern is not a brilliant idea. Regularly monitor the pattern and look for supporting signals like a bullish candle or increased volume. Also look a the RSI and MACD indicators to understand the pattern in a better way and validate the reversal.

3. Entre the Trade

While trading with a shooting star candle pattern, the trader has two options, i.e., to trade with an aggressive or conservative approach. In an aggressive approach, trading activity takes place immediately after the formation of a shooting start. On the other hand, in a conservative approach, traders wait for the shooting star candle to close or go downward with a moderate value. Traders can opt for either approach depending on the circumstances and market conditions.

4. Exit the Trade

Exiting the trade at the right moment is necessary to avoid huge losses or risks. The trader should stop before the asset value goes down to its opening price. Although it is considered better if a trader exits near key support levels or a bearish candlestick.

Things Every Trader Should Know While Trading with the Shooting Star Candlestick Pattern

There are certain things that a trader should keep in mind while trading with the shooting star candle pattern. The key considerations include the following:

- Understand the market context that a shooting star always appears after a significant uptrend and always reflects uncertainty or a reversal.

- It is always good to wait for the subsequent bearish price before taking action to remove the disparities in trading or negative consequences.

- Carefully analyse the trading volume. Usually, high trading during the formation of a start is an effective way to strengthen your trading and reduce the risk of losses.

- Understand the market conditions thoroughly and implement suitable stop-loss orders to protect your investment against uncertain market risks.

- Utilise technical analysis tools to the fullest to validate your trading strategies and effective decision-making.

Benefits of Trading with the Shooting Star Candlestick Pattern

- The pattern reflects a possibility of a sharp decline in prices, reflecting potential indicators and warning signals to the traders.

- It is quite easy to trade using this pattern as it is easy to identify, straightforward, and simplifies technical analyses.

- It is a versatile pattern and can be applied in different timeframes and varied markets.

Closing Line

Understanding the shooting star candlestick pattern helps traders to analyse the market carefully, understand increases or decreases in the asset’s price and make informed decisions. The key benefit of trading with the shooting star candlestick pattern is that it highlights the downtrend and gives a warning to the traders to exit the market. It is a safe and convenient method to enter the trading market, protect your investment, and reflect early signals to exit.

FAQs about The Shooting Star Candle Pattern

Does a shooting star candlestick pattern always reflect a downtrend in the market?

No, a shooting star candle reflects only a high possibility of a bearish reversal, but it is difficult to draw an exact conclusion from it.

Is there any limitation to trading with the shooting star candlestick pattern?

Yes, one of the major limitations is that the pattern is not always reliable, especially when you are trading in a volatile market.

What is the proven way to improve your shooting star candlestick trading skills?

You can go through deep market analysis, research and practice regularly to improve your skills to identify a shooting star candlestick.

Why shooting star candlestick pattern in trading matter?

Shooting star candlestick patterns are very important as they reflect the bearish reversal or decline in prices, allowing the trader to exit the market before the price goes down or they incur huge losses.